All Categories

Featured

Table of Contents

- – How does Borrowing Against Cash Value create f...

- – Can anyone benefit from Infinite Banking For F...

- – Bank On Yourself

- – What are the benefits of using Bank On Yourse...

- – What type of insurance policies work best wi...

- – What are the risks of using Infinite Banking...

- – How do interest rates affect Self-financing ...

Term life is the best service to a momentary need for shielding against the loss of an income producer. There are much less factors for irreversible life insurance. Key-man insurance and as component of a buy-sell arrangement come to mind as a feasible good factor to purchase a permanent life insurance policy policy.

It is an expensive term created to offer high valued life insurance policy with adequate commissions to the representative and large revenues to the insurer. Leverage life insurance. You can reach the same end result as limitless banking with better results, even more liquidity, no danger of a plan lapse setting off a large tax obligation problem and more choices if you utilize my alternatives

How does Borrowing Against Cash Value create financial independence?

My bias is excellent information so come back here and learn more articles. Compare that to the predispositions the promoters of infinity financial get. Here is the video clip from the marketer utilized in this post. 5 Mistakes People Make With Infinite Banking.

As you approach your golden years, economic security is a leading priority. Amongst the several different economic approaches around, you may be hearing an increasing number of concerning boundless financial. Infinite Banking cash flow. This idea allows just about anyone to become their very own bankers, using some advantages and flexibility that could fit well right into your retirement

Can anyone benefit from Infinite Banking For Financial Freedom?

The financing will certainly build up straightforward passion, but you preserve adaptability in setting repayment terms. The rates of interest is additionally generally less than what you 'd pay a typical financial institution. This type of withdrawal permits you to access a portion of your money worth (as much as the quantity you have actually paid in costs) tax-free.

Lots of pre-retirees have problems regarding the security of unlimited banking, and forever reason. While it is a legit strategy that's been adopted by individuals and businesses for several years, there are dangers and disadvantages to take into consideration. Infinite financial is not a guaranteed means to gather wealth. The returns on the money value of the insurance plan may rise and fall depending on what the market is doing.

Bank On Yourself

Infinite Financial is a financial technique that has obtained considerable focus over the previous couple of years. It's a distinct method to handling individual finances, enabling people to take control of their cash and produce a self-sustaining financial system - Tax-free income with Infinite Banking. Infinite Financial, also called the Infinite Banking Principle (IBC) or the Rely on Yourself technique, is an economic method that entails making use of dividend-paying entire life insurance policy plans to produce a personal banking system

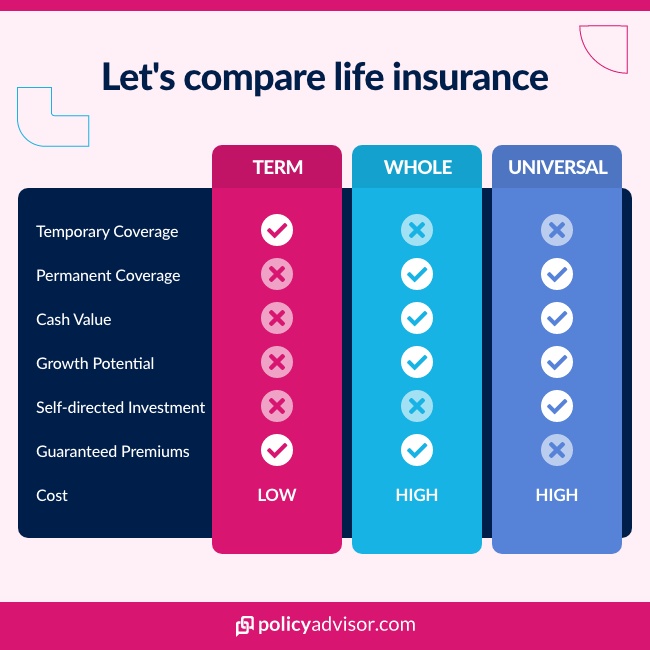

To understand the Infinite Banking. Concept technique, it is for that reason essential to offer an overview on life insurance coverage as it is a really misconstrued property course. Life insurance coverage is an important component of monetary planning that supplies many advantages. It comes in several sizes and shapes, the most usual types being term life, whole life, and global life insurance.

What are the benefits of using Bank On Yourself for personal financing?

Allow's explore what each kind is and exactly how they vary. Term life insurance coverage, as its name suggests, covers a details period or term, generally in between 10 to thirty years. It is the most basic and often the most budget-friendly kind of life insurance. If the insurance holder passes away within the term, the insurer will certainly pay the fatality benefit to the designated recipients.

Some term life plans can be renewed or exchanged a long-term plan at the end of the term, yet the premiums usually enhance upon renewal because of age. Whole life insurance policy is a kind of irreversible life insurance policy that supplies coverage for the policyholder's whole life. Unlike term life insurance policy, it includes a money worth element that expands gradually on a tax-deferred basis.

It's essential to bear in mind that any type of outstanding finances taken versus the policy will reduce the death advantage. Entire life insurance policy is generally much more expensive than term insurance coverage because it lasts a lifetime and constructs money value. It additionally supplies foreseeable premiums, indicating the expense will certainly not increase with time, giving a level of assurance for insurance holders.

What type of insurance policies work best with Infinite Banking Account Setup?

Some reasons for the misconceptions are: Complexity: Entire life insurance policy policies have extra complex attributes contrasted to term life insurance, such as money value accumulation, dividends, and policy loans. These features can be challenging to understand for those without a history in insurance or personal finance, resulting in complication and misunderstandings.

Bias and false information: Some people may have had negative experiences with entire life insurance policy or listened to stories from others that have. These experiences and anecdotal info can contribute to a prejudiced view of whole life insurance policy and continue misconceptions. The Infinite Financial Idea method can only be carried out and performed with a dividend-paying entire life insurance policy policy with a mutual insurance policy firm.

Entire life insurance is a kind of permanent life insurance policy that provides protection for the insured's whole life as long as the premiums are paid. Entire life plans have 2 main components: a death advantage and a cash money worth (Wealth building with Infinite Banking). The death benefit is the amount paid out to recipients upon the insured's death, while the cash value is a savings component that grows with time

What are the risks of using Infinite Banking Wealth Strategy?

Returns payments: Common insurance provider are had by their insurance policy holders, and as an outcome, they may distribute revenues to insurance policy holders in the kind of rewards. While dividends are not guaranteed, they can aid boost the cash worth growth of your plan, boosting the overall return on your capital. Tax obligation advantages: The money value development within an entire life insurance policy policy is tax-deferred, meaning you do not pay tax obligations on the development till you take out the funds.

Liquidity: The money value of an entire life insurance plan is extremely fluid, enabling you to access funds conveniently when needed. Asset protection: In several states, the cash money worth of a life insurance coverage policy is safeguarded from lenders and claims.

How do interest rates affect Self-financing With Life Insurance?

The policy will have prompt cash money worth that can be put as security thirty day after moneying the life insurance policy policy for a rotating line of credit scores. You will certainly be able to access via the rotating line of credit history as much as 95% of the offered money value and make use of the liquidity to money a financial investment that offers revenue (cash money flow), tax benefits, the opportunity for appreciation and utilize of other individuals's ability, capabilities, networks, and funding.

Infinite Financial has actually become preferred in the insurance policy world - a lot more so over the last 5 years. Several insurance policy agents, around social networks, insurance claim to do IBC. Did you understand there is an? R. Nelson Nash was the designer of Infinite Banking and the company he founded, The Nelson Nash Institute, is the only organization that officially authorizes insurance policy representatives as "," based on the adhering to standards: They line up with the NNI requirements of expertise and principles.

They successfully finish an apprenticeship with an elderly Licensed IBC Expert to ensure their understanding and capability to use every one of the above. StackedLife is Accredited IBC in the San Francisco Bay Location and works nation-wide, aiding customers comprehend and apply The IBC.

Table of Contents

- – How does Borrowing Against Cash Value create f...

- – Can anyone benefit from Infinite Banking For F...

- – Bank On Yourself

- – What are the benefits of using Bank On Yourse...

- – What type of insurance policies work best wi...

- – What are the risks of using Infinite Banking...

- – How do interest rates affect Self-financing ...

Latest Posts

Borrowing Against Whole Life Insurance

Becoming Your Own Banker Book

Learn How To Become Your Own Bank!

More

Latest Posts

Borrowing Against Whole Life Insurance

Becoming Your Own Banker Book

Learn How To Become Your Own Bank!